Investment Opportunity

Opportunities

With the near-term outlook for real estate performance becoming clouded and non-performing assets turning race up because of rising interest rates and lingering fears of a recession, CRESCO CAPITAL MANAGEMENT, as professional investment manager, clearly catches sight of investment opportunities and be working about putting together funds targeting opportunistic distressed real estate and non-performing assets investments.

NPL/NPA Market in Thailand

Key information about Thailand Non-Performing Loans

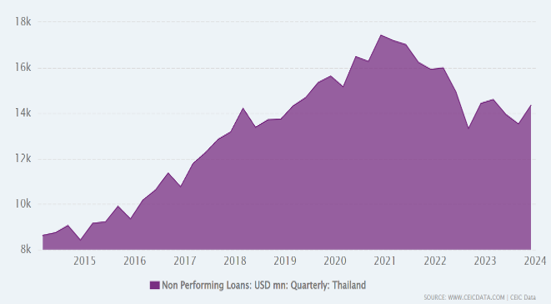

•Thailand Non-Performing Loans was reported at 13.919 USD bn in Jun 2024

•This records an increase from the previous number of 13.843 USD bn for Mar 2024

•The data reached an all-time high of 73.275 USD bn in Dec 1998 and a record low of 8.129 USD bn in Dec 2013

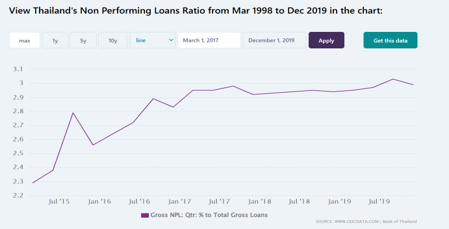

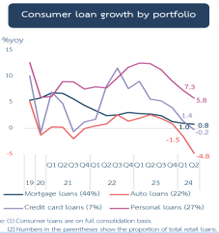

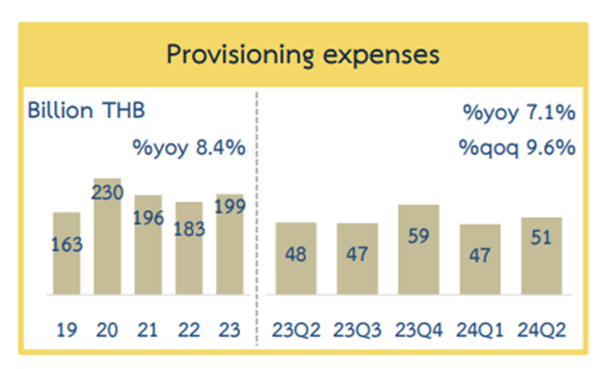

The Thai banking system remains resilient with robust levels of capital, loan loss provisions (especially from NPL), and liquidity. In the second quarter of 2024, loan growth of the banking system (licensed banks and their subsidiaries) slowed down to 0.3% year-on-year. The banking system’s gross non-performing loans (NPL or stage 3) in the second quarter of 2024 increased to 540.8 billion Baht, equivalent to the NPL ratio of 2.84%.

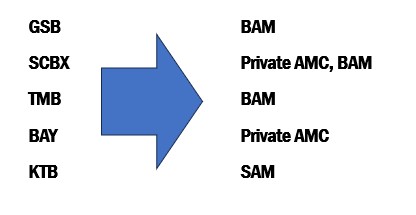

Key assets holders are under pressure

The National Credit Bureau (NCB) has announced it recorded a 15% rise in non-performing loans (NPLs) in Q1 2024, driven by defaults on auto and mortgage loans. NPLs reached 1.09 trillion baht, with auto NPLs surging by 32% to 240 billion baht and housing NPLs increasing by 18% to 1.99 billion baht. Even though JVAMC was created in 2022 by Thai banks under BOT’s tightened control, the majority secured NPL is still under banks possession. The unsecured NPL is mostly transfer to the JV. Despite the fact that this could become a viable alternative for the banking system to dispose of its NPLs, it reverses the market-driven path, which was initiated and originally planned by BoT itself. Additionally, excessive use of this JV approach could bring the NPL industry back to the early days after the Asian crisis, where a bilateral and non-market approach was implemented with close monitoring.

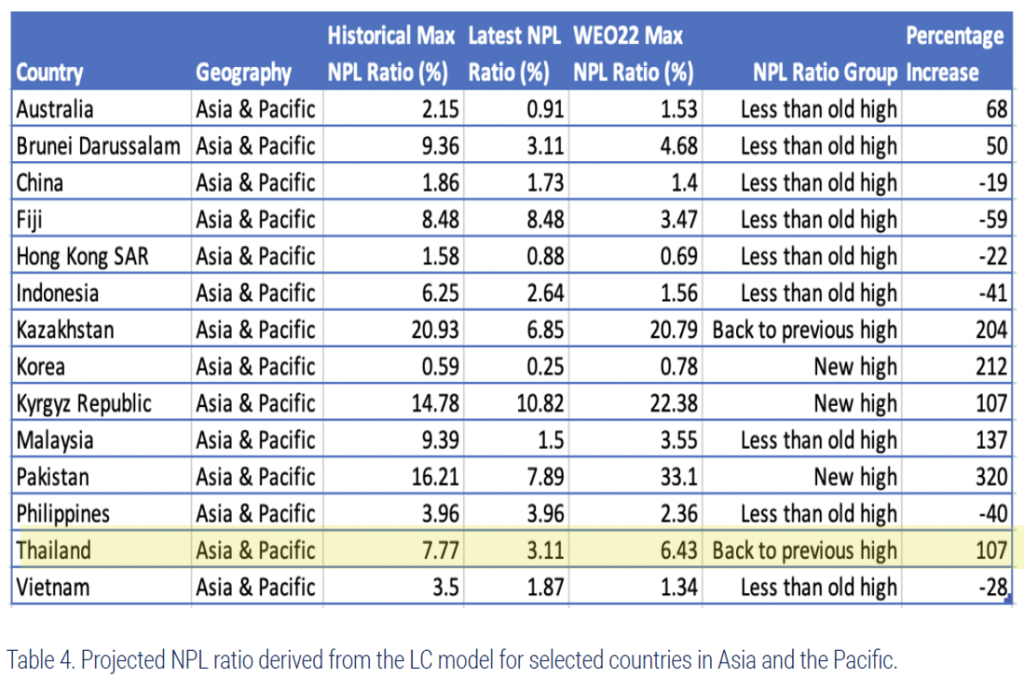

As trend to increase of NPL back to previous high, BoT considered to implement a real approach to improve NPL situation of Thai banks as “off the banks’ book” basis and allow the banks to realize upside gains from the recovery (if any). The banks would be better off selling the assets now at the possible price (using mechanisms established since the Asian financial crisis).

Ways to minimize impacts

Thai banks and government AMC start releasing its NPL and NPA to open market since new coming NPL is expected to increase in the near future. The banks are cleaning its NPL and NPA portfolios with both approaches of JVAMC and sale to open market. Transactions are in status of completed and on-going in 2023-24.